The fintech industry is experiencing massive growth, with the number of users globally engaging in digital payments expected to increase by over 48% in just the next five years. This growth isn't limited to digital transactions; it also includes a surge in new fintech companies and innovations driven by AI, advancements in open banking, and rising demand for mobile-first digital experiences.

In this article, we’ll help you navigate the complex financial app development process, providing you with 10 critical “do’s and don’ts” to help your app stand out in this overcrowded and competitive market. Let’s jump right in!

The status of financial app development in 2025

In 2025, financial app development continues to evolve at a rapid pace, driven by advancements in technology, changing user expectations, and an increasingly complex regulatory landscape. In response, financial institutions and fintech startups are focusing on creating more sophisticated, secure, and user-friendly applications.

Financial app development trends

Some of the key trends that are shaping the finance app development landscape in 2025 include:

- Rise of AI-powered features: AI-powered features, such as personalized financial advice, predictive analytics, and advanced fraud detection, are becoming commonplace in modern financial apps. Machine learning algorithms help analyze user behavior and financial data, providing tailored financial advice, and delivering customized experiences and proactive financial management.

- Widespread adoption of contactless payments: Contactless payments have become the most preferred payment solution. The convenience and safety of contactless transactions have led to their widespread adoption, driving innovation in payment technologies, particularly within personal finance apps.

- Implementation of open banking regulations: The implementation of open banking regulations has led to seamless data sharing and integration, resulting in more comprehensive and user-centric financial solutions. Navigating the complex regulatory environment remains a top priority. Developers must ensure their apps comply with regional and international regulations, such as GDPR, PSD2, and other financial industry standards.

- Mobile-first banking experience: The ubiquity of mobile phones and access to technology has ensured banking has become a non-physical customer experience. Mobile banking apps have become the primary interface for financial transactions.

Challenges financial institutions face

Given this landscape, every financial app developer, whether part of new fintech startups, unicorns, or traditional institutions, is facing challenges in areas such as:

- Scalability and performance: As user bases grow, ensuring apps can scale efficiently without compromising performance is a critical challenge.

- User experience: In a market saturated with options, a seamless user experience can be the key differentiator. Developers must strike a balance between simplicity and advanced features.

- Innovation and differentiation: The competitive fintech landscape demands relentless innovation. Simply keeping up is not enough; fintech apps must offer unique features and superior user experiences to stand out.

5 do’s of financial app development

Adhering to best practices is essential to overcome the core challenges you are up against as financial app developers. This section will cover the critical "do's" that developers should prioritize to ensure their apps are secure, scalable, and capable of delivering exceptional user experiences. Let’s start by looking at how narrowing in on a specific niche can help set your finance app up for success:

Identify a specific niche

Before diving into developing your fintech app, it’s crucial to identify the right niche to target. This foundational step involves thorough research and strategic planning in the following areas:

- Area of focus: This helps in narrowing down your target audience and defining the core functionalities of your app. For instance, you might focus on personal finance management, mortgage lending support, global money transfers, trading platforms, crowdfunding, or mobile banking. Each area has its unique set of requirements and user expectations, so it's essential to choose one that aligns with your expertise and market demand.

- Type of app: Determine the specific type of app you wish to build and what it will do. Think through if you’re interested in web or mobile app development (or both).

- Target audience: Identify your target audience and understand their needs. Consider whether they belong to a specific demographic group or region. This insight will guide your app's design and feature set to cater to their preferences.

- Geographic scope: Consider the regulatory environment of the regions you plan to target. Regulations vary significantly from one region to another, adding complexity to the development process. For example, compliance with GDPR in Europe, CCPA in California, and local banking regulations in various countries is essential to ensure your app meets all legal requirements and protects user data effectively.

PRO TIP: Conduct thorough market research and competitor analysis to uncover gaps and opportunities in your chosen niche. This will not only help in refining your app's unique selling proposition (USP) but also ensure it addresses unmet needs within your target market.

Read More: 8 Step Proof of Concept Template – Validate Your Idea Fast

Prioritize user security and privacy

Protecting user security and privacy is paramount for any fintech app development project because the increasing prevalence of cyber threats poses significant risks to sensitive financial information. To safeguard user data effectively, these security measures must be thoughtfully incorporated into the app development process:

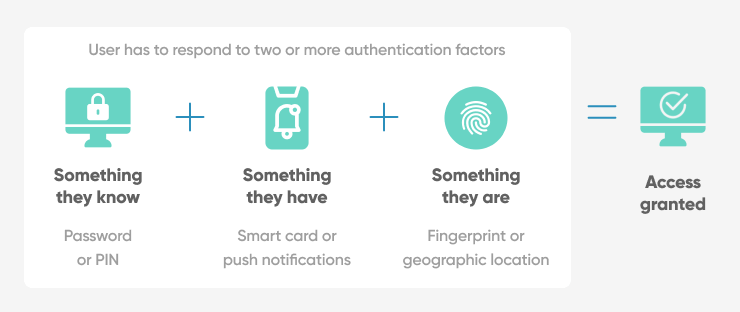

- Strong authentication methods: Utilize multi-factor authentication (MFA) to add an extra layer of security beyond passwords. This can include biometric verification, SMS/email codes, and hardware tokens.

- Encryption of sensitive data: Employ encryption for data at rest and in transit. Use industry-standard encryption protocols such as AES-256 to safeguard user data from unauthorized access.

- Compliance with regulations: Adhere to relevant regulatory standards in the countries you will launch in, such as GDPR, CCPA, and PCI-DSS. Ensure that your app's data handling practices align with these regulations to protect user privacy.

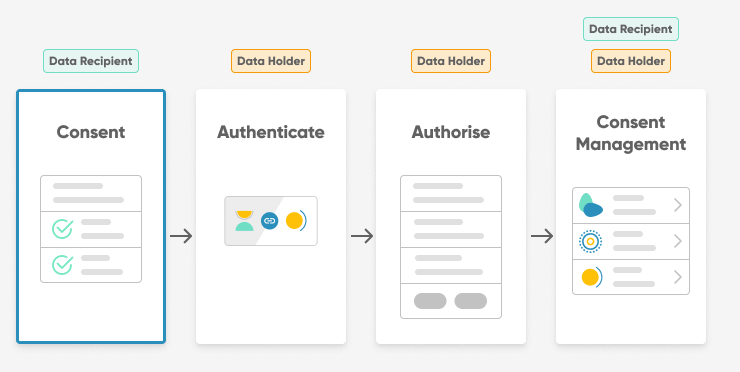

- Consent management: Implement a robust consent management system to allow users to easily manage and withdraw their consents for data sharing. This system should provide clear options for users to update their permissions and view their consent history. Specifically for open banking applications, there’s a defined consent flow that needs to be followed in order to comply with regulations such as PSD2.

Leverage open banking APIs

Leveraging open banking APIs with the help of mobile app development experts is critical for developing cutting-edge financial applications that meet the evolving needs of today's users. These APIs provide access to a vast array of financial data and services, enabling developers to create more integrated, personalized, and efficient financial solutions.

By utilizing Open Banking APIs, financial apps can offer users a seamless experience, consolidating various financial accounts and transactions into a single, user-friendly interface. This not only enhances user convenience but also fosters greater engagement and satisfaction by providing tailored financial insights and recommendations.

Some examples of open banking APIs include:

- Plaid Identity: Facilitates seamless account verification by directly connecting merchants to consumer bank accounts, allowing retrieval and verification of information such as account and routing numbers.

- Finicity by Mastercard: Offers open banking solutions that provide consumer-permissioned financial data, enabling secure data exchange among banks, fintech firms, and third-party providers in real-time.

- Yapily: Europe’s largest open banking platform with 2,000+ bank integrations, providing real-time financial information for budgeting and savings.

Incorporate AI personalization

Incorporating AI personalization into your finance management app can significantly enhance user experience by delivering tailored services and insights. AI-driven personalization analyzes user behavior, preferences, and financial data to offer customized recommendations and solutions. This not only increases user engagement but also fosters loyalty by providing a more relevant and intuitive experience. There’s no shortage of ways to incorporate AI into a fintech app, but some notable applications of AI include:

- Tailored financial advice: AI can provide personalized financial advice based on users' spending patterns, saving habits, and financial goals, making it an essential feature in a personal finance app.

- Custom alerts and notifications: Personalized alerts for spending limits, bill payments, and investment opportunities keep users informed and proactive about their finances.

- Adaptive user interfaces: AI can adjust the app’s interface and features to align with individual user preferences, making navigation more intuitive and user-friendly.

- Predictive analytics: Leveraging AI, the app can predict future financial needs and behaviors, offering proactive solutions like savings plans or investment strategies.

- Enhanced customer support: AI-driven chatbots and virtual assistants can provide personalized support and guidance, resolving user queries more efficiently.

Work with an experienced development team

Collaborating with experienced financial app developers is essential due to the industry's complexity and rapidly changing landscape. Navigating stringent regulations, integrating advanced technologies, and ensuring robust security measures require a team with deep expertise. An adept development team can prevent costly rework, reduce cycle times, and guarantee that your app is not only functional but also secure, scalable, and user-friendly.

Here’s a few things to look for when hiring a software development company or financial app developer:

- Compatible outsourcing model: Determining the right outsourcing model is pivotal for project success. From staff augmentation, where you own the project, to managed team models with shared responsibilities, or the project-based model where the provider handles most tasks, the choice depends on your control preference.

- Clear pricing structure: Grasping the pricing structure is another complex aspect of hiring a software development team or freelance software developers. You'll need to understand all potential costs, from upfront charges to ongoing maintenance fees and possible additional costs. Transparency in pricing can help you better manage your budget and avoid surprises later.

- Portfolio of relevant projects: Evaluating the portfolio of software developers can help you gauge their experience and capability. You'll need to consider whether they have successfully completed projects similar to yours, giving you a clear understanding of their range of skills and their ability to handle your project's specific requirements.

- Positive client reviews: Client reviews provide a window into the past performance of a software developer. Positive reviews can give you a sense of the company's reliability, professionalism, and the quality of their work.

- Strong communication skills: Communication is an often overlooked but critical aspect of software and web development. The best software developers are not just technically competent but also able to communicate well with each other, project managers, and business leaders.

- Good culture fit: Regardless of if you’re hiring freelance software developers or a software company, you need to consider if they are a good culture fit for your in-house team. Identifying a full-stack developer or software company whose work ethics, values, and communication styles align with yours can contribute to a more harmonious and productive working relationship. This requires a keen understanding of both your own organizational culture and the culture of your potential partner.

5 don’ts of financial app development

While understanding best practices is crucial, it's equally important to be aware of common pitfalls to avoid in financial app development. This section will highlight the critical "don'ts" that can jeopardize the success and security of your application:

Don’t expect regulatory compliance to be one and done

The financial industry is subject to constantly evolving regulations, standards, and best practices designed to protect consumers and ensure the integrity of financial systems. As a result, maintaining compliance requires continuous monitoring, regular updates, and proactive adaptation to new requirements.

Here are some key considerations for ongoing compliance:

- Conduct regular audits and assessments: Conduct frequent audits to identify compliance gaps and address them promptly. This includes internal reviews and external audits by regulatory bodies.

- Stay informed on regulatory changes: Keep abreast of changes in the regulatory landscape. Subscribe to industry newsletters, participate in webinars, and engage with professional organizations to stay updated.

- Update policies and procedures: Regularly review and update your app's policies and procedures to reflect the latest regulatory requirements and industry standards.

- Continuously train your team: Ensure your team is well-informed about current compliance requirements through ongoing training and education programs.

- Implement robust compliance management systems: Utilize compliance management software to track regulatory requirements, manage documentation, and streamline reporting processes.

Don’t ignore mobile-first design

Prioritizing mobile-first design is crucial for financial app development. With the majority of users accessing financial services through their smartphones, creating a seamless and intuitive mobile experience is essential. By working with a mobile app development company, you can leverage their expertise to implement key elements of mobile-first design such as:

- Simplified navigation: Use intuitive navigation structures that make it easy for users to find and access the features they need in their mobile apps.

- Touch-friendly interfaces: Design with touch interactions in mind, ensuring buttons, links, and other interactive elements are easily tappable.

- Streamlined content: Prioritize essential information and actions, minimizing clutter and focusing on the most critical features and content in the mobile banking app.

- Adaptive layouts: Use adaptive and flexible layouts that adjust seamlessly to different screen sizes and orientations.

PRO TIP: Navigating country-specific regulations for mobile payments and verification is crucial. For example, in Europe, compliance with PSD2 regulations is necessary for mobile payments, which includes strong customer authentication (SCA). In India, adhering to the Reserve Bank of India's guidelines for mobile wallet providers is essential, including KYC (Know Your Customer) verification processes. Always stay updated with local regulations to ensure compliance and smooth operation of your financial app.

Read More: UI Design Process - 7 Easy Steps to Make Great UIs Faster

Don’t rely solely on traditional security measures

Relying solely on traditional security measures is no longer sufficient to protect against the sophisticated threats that modern apps face. Cybersecurity threats are continually evolving, and financial apps, given the sensitive nature of the data they handle, are prime targets. To safeguard your app and its users effectively, it's crucial to adopt a multi-layered security approach that goes beyond conventional methods.

One key strategy is the implementation of Multi-Factor Authentication (MFA). By requiring users to verify their identity through multiple forms of authentication—such as passwords, biometrics, and hardware tokens—MFA significantly reduces the risk of unauthorized access, even if passwords are compromised. Additionally, encryption plays a vital role in protecting sensitive data. Using strong encryption protocols like AES-256 for data at rest and in transit ensures that even if data is intercepted, it remains unreadable to unauthorized parties.

Another critical approach is the adoption of Zero Trust Architecture. This model operates on the principle that threats can come from both outside and inside the network, necessitating strict verification for every access request.

By assuming that no entity, whether inside or outside the network, can be trusted by default, Zero Trust enforces rigorous authentication and authorization protocols. Behavioral analytics further enhance security by monitoring user activities to detect unusual patterns that may indicate a breach. These tools enable rapid response to potential threats, minimizing damage and protecting user data.

Don’t underestimate the importance of load testing

Load testing ensures that your application can handle high volumes of traffic and transactions without compromising performance or user experience. In the financial sector, where users expect real-time responses and seamless transactions, any slowdown or downtime can lead to significant user dissatisfaction and potential financial loss. Some of the key load testing strategies include:

- Simulate real-world scenarios: Create realistic test scenarios that mimic actual user behavior and transaction patterns to ensure your app can handle real-world usage.

- Test with peak loads: Simulate peak traffic conditions to evaluate how your app performs under the highest levels of stress it is likely to encounter.

- Continuous testing: Integrate load testing into your continuous integration and deployment (CI/CD) pipeline to regularly assess performance and address issues proactively.

- Analyze results and optimize: Thoroughly analyze load testing results to identify performance issues and optimize code, database queries, and server configurations accordingly.

- Prepare for future growth: Use load testing to anticipate future growth and ensure your app is ready to scale, accommodating increasing user demands without sacrificing performance.

Don’t overlook long-term scalability demands

Planning for long-term scalability is crucial to ensure that your application can grow alongside your user base and evolving business needs. Overlooking scalability can lead to performance issues, user dissatisfaction, and potentially costly overhauls down the line. Building your app with scalability in mind from the outset ensures that it can handle increasing loads, new features, and additional data without compromising performance. Some of the key strategies for ensuring scalability include:

- Modular architecture: Design your app with a modular architecture that allows individual components to be scaled independently. This enables more flexible and efficient scaling.

- Cloud services: Utilize cloud services for scalable infrastructure. Cloud platforms offer scalable resources that can be adjusted based on demand, ensuring your app can handle varying loads.

- Load balancing: Implement load balancing to distribute traffic evenly across servers, preventing any single server from becoming a bottleneck.

- Database optimization: Optimize your database for scalability by using techniques such as sharding, indexing, and caching to handle large volumes of data efficiently.

- Microservices: Consider adopting a microservices architecture, which divides your application into smaller, independent services that can be scaled individually.

Conclusion

In 2025, financial app development is rapidly advancing, driven by technological innovation and evolving user expectations. By focusing on key trends, addressing challenges, and adhering to best practices, developers can create secure, scalable, and user-friendly financial applications. Embracing these strategies will ensure long-term success and position your app to meet the dynamic needs of modern users in a competitive market.

If you’re looking for a development team to bring your financial app vision to life, we’d love to help. We offer financial software development services that simplify the implementation process, enabling you to achieve business results without the hassle. Our team will guide you in selecting the right technologies, planning development, and building an end-to-end solution that perfectly aligns with your business requirements or startup goals.

![10 Dos and Don'ts - Financial App Development [2025 Guide]](/.netlify/images?url=_astro%2Ffinancial-app-development.Dkv_691G.png)