The number of fintech API calls is projected to surge nearly 500% from 2023 to 2027. This exponential growth reflects the rapid expansion of services driven by new open banking policies, increased innovation in the fintech sector worldwide, and a public that is quickly embracing digital financial services applications.

In this article, we will delve into seven specific use cases of these APIs that are revolutionizing the financial industry in 2024, so you can stay ahead of the curve and see how top startups and enterprise companies alike leverage fintech APIs to deliver innovative products and services to their users.

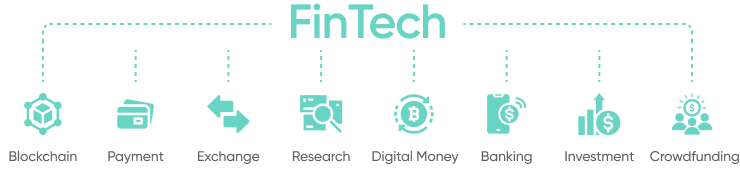

What are FinTech APIs?

Fintech APIs (application programming Interface) are tools that allow financial technology applications to connect and interact with various financial services and systems. They enable the integration of financial data and functions such as online payments, banking, stock market data, and data analytics. By leveraging fintech APIs, developers can access financial data via open banking to build more innovative and personalized financial services and products.

What are the benefits of using FinTech APIs?

Like other APIs, FinTech APIs simplify the development process, enabling developers to build powerful software products more easily. They open up a range of new opportunities for creating innovative solutions, from enterprise business applications to consumer-focused tools. Let’s explore the key benefits.

- Lowers development costs: FinTech APIs provide pre-built financial functionalities, significantly reducing the need for custom development. This not only lowers the overall development costs but also allows companies to allocate resources more efficiently towards innovation and enhancing user experiences.

- Reduced time to market: By leveraging a financial data API from a financial data provider, businesses can rapidly integrate essential financial services into their applications, drastically reducing the time to market. This accelerated development process enables companies to quickly launch new products and services, staying ahead of competitors in a fast-paced market.

- Helps with compliance: APIs also facilitate compliance with stringent regulations like GDPR and PSD2 by providing standardized, secure, and regulatory-compliant methods for handling financial data. This ensures that businesses can meet legal requirements while focusing on delivering high-quality financial solutions to their customers.

7 FinTech API use cases transforming financial services

Now that we’ve looked at the key benefits of fintech APIs, how are companies actually leveraging this technology? In this section we’ll look at the top 7 use cases that are transforming financial services.

Payment processing

When you think of fintech, payment processing APIs are likely the first type that comes to mind. They are the backbone of everyday transactions that most people interact with without even realizing they are powered by APIs.

These APIs provide the necessary tools for processing web and mobile payments, managing transactions, and supporting various payment methods such as credit cards, digital wallets, and bank transfers. By integrating payment processing APIs, businesses can offer secure and efficient payment options, streamline the checkout process, and enhance the overall user experience without extensive custom software development.

Ideal for: E-commerce platforms, subscription services, retail stores, and software developers/startups needing online payment capabilities.

API examples:

- Stripe: Takes care of the entire payment process, from transaction initiation to funds settlement, allowing businesses to accept payments from credit cards, debit cards, and digital wallets.

- Braintree: Allows developers to integrate its global payments platform, supporting various payment methods, including cards, wallets, and local payment methods.

- MangoPay: Facilitates online banking transactions, especially in crowdfunding, marketplace, and sharing economy platforms.

- GoCardless: Enables collecting payments via a single integration, including automated payment collection and reconciliation.

Case study:

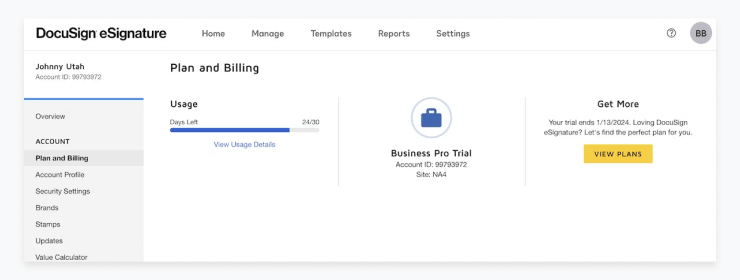

DocuSign is a global SaaS brand that helps businesses manage electronic agreements, and is on a mission to accelerate business and simplify life for companies of all sizes.

DocuSign identified a gap in their payment options, especially in countries where debit purchases are so popular like the Netherlands and Germany. GoCardless's API provided a way for Docusign to integrate this new bank payment option to customers directly in their existing subscription management platform, Zuora.

Identity verification (KYC)

Identity verification - also known as KYC (Know Your Customer) - APIs are essential tools for businesses that need to verify the identities of their customers to comply with regulatory requirements and reduce the risk of fraud. These APIs provide automated solutions for verifying personal information, such as names, addresses, dates of birth, and government-issued IDs.

They utilize various methods, including document scanning, biometric verification, and database checks, to authenticate users quickly and accurately. This not only speeds up the onboarding process but also ensures that businesses meet the necessary compliance standards without the need for extensive manual verification.

Ideal for: Financial institutions, fintech companies, e-commerce platforms, and any business needing to verify user identities.

Example APIs:

- Trulioo API: Provides global identity verification services to help businesses comply with KYC and AML regulations by verifying customer identities across multiple countries.

- Jumio API: Provides identity verification services using document verification, facial recognition, and authentication technologies to ensure secure and compliant onboarding.

- Onfido API: Offers automated identity verification and background checks by validating government-issued IDs and performing biometric verification to authenticate users.

- IDnow API: Facilitates real-time identity verification through video identification and e-signature capabilities, ensuring compliance with KYC regulations.

- Shufti Pro API: Provides identity verification and KYC services, including document verification, face verification, and AML screening, to help businesses comply with regulatory standards.

Case study:

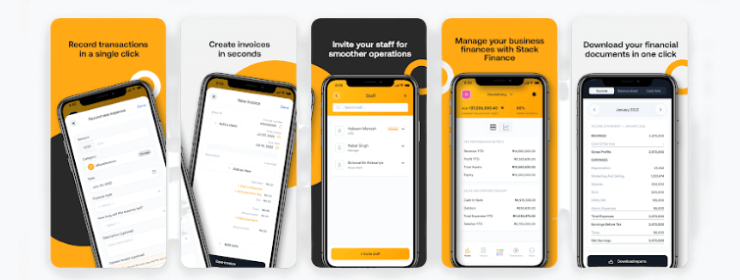

STACK, a fintech API, combines advanced machine learning with customizable tools to help millennials reach their financial goals with automated savings, weekly budgeting, and fee-free services while also rewarding them in real-time with offers from merchants where they shop.

But STACK needed digital identity verification to quickly, securely and smoothly on board members while maintaining compliance with Anti-Money Laundering (AML) and KYC regulations. STACK leverages Trulioo during member onboarding to verify identities and meet AML, KYC and FINTRAC requirements.

Banking integration

Banks have historically maintained a "closed" system, prioritizing security but restricting the real-time financial data aggregation. However, the rise of open banking APIs has transformed this landscape, enabling secure data sharing across approved platforms via banking APIs. This shift in the financial sector benefits personal finance app developers by reducing the burden of building highly secure systems and meeting regulatory requirements, while consumers enjoy a wider array of financial services and tools.

The current phase of open banking, often referred to as open finance, extends open banking principles to a broader range of financial products, including savings accounts, mortgages, and insurance. This wave is also characterized by the participation of non-financial industries and evolving regulatory frameworks to accommodate these new use cases.

Ideal for: Personal finance apps, budgeting tools, multi-bank management platforms, bookkeeping software, payroll systems, and expense management software.

Example APIs:

- Plaid: Allows developers to securely link bank accounts to other applications, without users having to leave their site.

- Syncfy Connect: Enables financial data retrieval directly from the source using Open Finance; imports data from banks, utility providers, digital wallets, credit cards, and major blockchain networks.

- Yodlee: Combines financial insights with data from 17,000 sources and is designed to make transaction data easier to understand.

- MX: Aggregates and enhances financial data, empowering organizations to provide better financial experiences for their customers.

- Finicity: Offers an open banking platform and data aggregation solution, powered by Mastercard.

Case study:

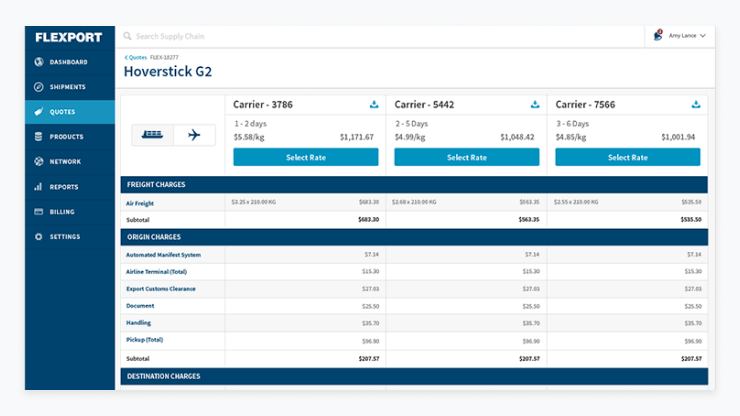

Flexport is a global trade technology company that provides buyers, sellers, and their logistics partners with the technology and freight services needed to grow and innovate. To meet their clients' full financing needs more effectively, Flexport required timely information. By integrating Plaid, Flexport gained access to user-permissioned bank account balances and transaction histories, allowing them to better address client financing requirements and drive growth.

With Plaid's real-time financial monitoring, Flexport no longer relies on monthly financial updates or bank statements, instead gaining immediate insights into their clients' financial health. This access to real-time bank data enables Flexport to minimize risk and offer loans that they might have otherwise deemed too risky. Additionally, Plaid simplifies ongoing reporting for Flexport Capital's clients, reducing their effort and streamlining processes.

Virtual accounts

Virtual accounts offer the ability to create and manage multiple virtual identifiers under a single physical bank account. This enables precise tracking and allocation of funds for different purposes, such as managing client funds, streamlining payment processes, and enhancing financial reporting.

By utilizing virtual accounts, businesses can simplify their financial operations and improve efficiency. For example, companies can assign virtual accounts to different clients or projects, making it easier to monitor and reconcile transactions. Virtual accounts also support automated payment processing and collection, reducing manual effort and minimizing errors.

Ideal for: Companies with complex payment and collection needs, financial service providers, and fintech companies.

Example APIs:

- Sila: Allows US users to set up digital wallets with dedicated account and routing numbers to facilitate ACH transactions, wire transfers, and improve cash flow and reconciliation processes for fintech applications.

- Plaid Virtual Accounts: Lets UK and Europe users manage the entire lifecycle of payments, including creating, fetching, listing virtual accounts, executing transactions, and even refunding payments.

Case study:

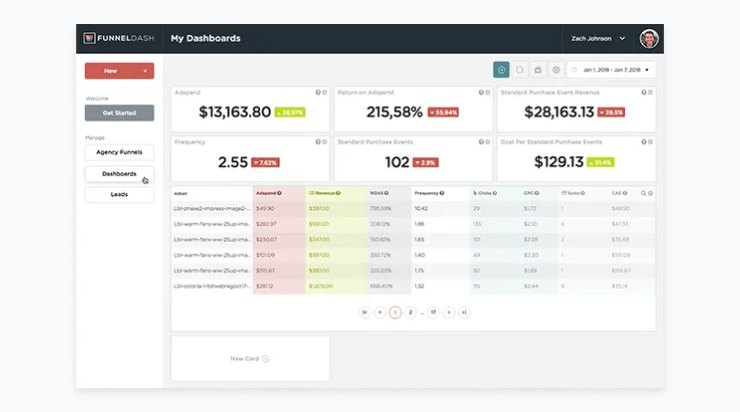

FunnelDash utilized Sila's payment infrastructure and blockchain technology, along with virtual card issuance through a partner, to offer a powerful charge card specifically for digital ad spend. This customized bank card and payment infrastructure is designed to provide cashback and online support tailored for digital ad agencies, which often spend upwards of eight figures annually on advertising.

With Sila's advanced technology, FunnelDash now empowers its users to issue corporate branded virtual and physical cards, enable money transfers and secure bank account linking, send money along the blockchain, and offer solid cashback rewards for card spending. This partnership allows FunnelDash to challenge the status quo and deliver more value to business owners in the advertising industry.

Cryptocurrency APIs

The cryptocurrency market is known for its volatility and fast-paced nature, requiring timely and accurate data for informed decision-making. Cryptocurrency APIs enable innovation by allowing developers to build advanced applications that can respond quickly to market changes, automate trading strategies, and ensure secure transactions. These APIs also support regulatory compliance and offer enhanced security features, making it easier to develop reliable and sophisticated digital currency solutions.

Ideal for: Trading platforms, fintech startups, wallet providers, and blockchain developers.

Example APIs:

- CoinGecko API: Provides comprehensive data on cryptocurrency prices, market capitalization, trading volume, and historical data for thousands of digital currencies.

- Coinbase API: Offers access to cryptocurrency trading, wallet management, and real-time price information for various cryptocurrencies available on the Coinbase platform.

- Binance API: Enables trading on the Binance exchange, providing market data, trade execution, and account management features.

- CoinAPI.io: Provides a collection of cryptoAPIs all in one place.

Case study:

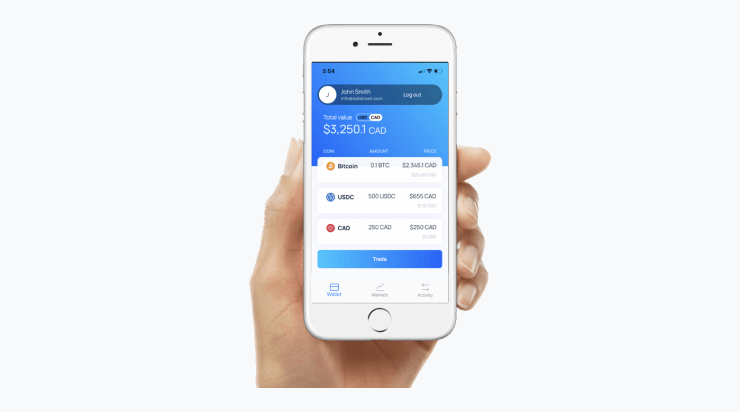

Satstreet needed a reliable real-time cryptocurrency price source to translate complex data into clear insights for their clients and internal use. This capability allows them to efficiently run their trading desk, ensuring superior trade execution services and dependable reporting. Satstreet integrated with CoinAPI's live pricing and charting library.

With CoinAPI, Satstreet ensures their clients have access to essential price data. By aggregating prices from multiple sources, Satstreet provides comprehensive market comparisons, empowering clients to make informed decisions. Satstreet stands out as a premium service provider in the cryptocurrency trading space.

Access market data

APIs that exchange data to provide real-time and historical financial information from various markets, including stock exchanges and commodity markets can facilitate more informed decision-making and strategic planning. By integrating market data APIs, businesses can build applications that offer portfolio tracking, automated trading, financial analysis, and risk management features. Features such as data filtering, aggregation, and visualization tools enhance the usability and value of the raw market data, enabling businesses to offer more sophisticated financial products and services.

Ideal for: Financial institutions, trading platforms, investment firms, fintech startups developing trading apps, portfolio management tools, and financial news services.

Example APIs:

- Bloomberg API: Delivers market data, news, and analytics, including comprehensive financial information from global markets.

- Morningstar API: Provides data on stocks, mutual funds, ETFs, and market indices, along with financial metrics and performance analysis.

- Nasdaq Data Link: Offers a variety of datasets including real-time and historical market data, financials, and economic data.

- Polygon.io: Provides access to real-time options prices, historical data, and news on all major options markets including CBOE, NYSE, and NASDAQ.

Case study:

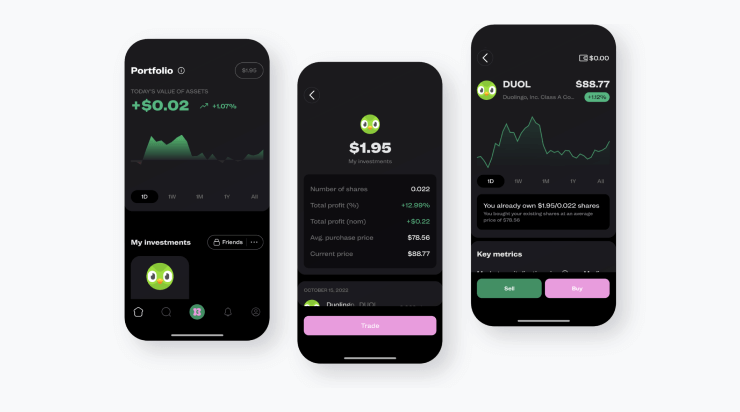

Birdwingo, the first platform of its kind to enter the European market, offers Gen Z and Millennials a way to discover companies and build investment portfolios that align with their personal values and preferences.

Birdwingo quickly became operational thanks to Polygon.io API. By accessing the Starter.feed, they were able to obtain real-time data immediately, allowing developers to create a proof of concept without the need to communicate with any exchanges.

Subsequently, Birdwingo upgraded to the poly.feed product from Polygon.io to display real-time price data from Nasdaq, NYSE, and IEX for their app launch. Additionally, Birdwingo leverages the Ticker Details API endpoint to populate fields such as daily market cap, logos, and standard industry classification codes, creating a rich and engaging user interface for their users.

OCR and machine learning

Machine learning and OCR (Optical Character Recognition) APIs are transformative for fintech applications, enabling advanced data processing and automation. Typically, OCR APIs utilize machine learning to convert scanned documents and images into machine-readable text, automating the extraction of information from invoices, receipts, and identity documents. This enhances the accuracy and efficiency of data entry, compliance checks, and customer onboarding processes.

Machine learning APIs can also analyze large volumes of financial data to identify patterns, predict market trends, and detect fraudulent activities, providing valuable insights for decision-making and risk management. The combination of these technologies allows fintech companies to streamline operations, reduce manual errors, and improve overall service delivery.

Ideal for: Financial institutions, fintech startups, insurance companies, and businesses dealing with large data volumes and documents.

Example APIs:

- Google Cloud Vision API: Offers powerful image analysis capabilities, including text extraction from documents, enhancing accuracy and efficiency.

- Azure AI Document Intelligence: Extracts information from forms and documents, automating data entry and processing.

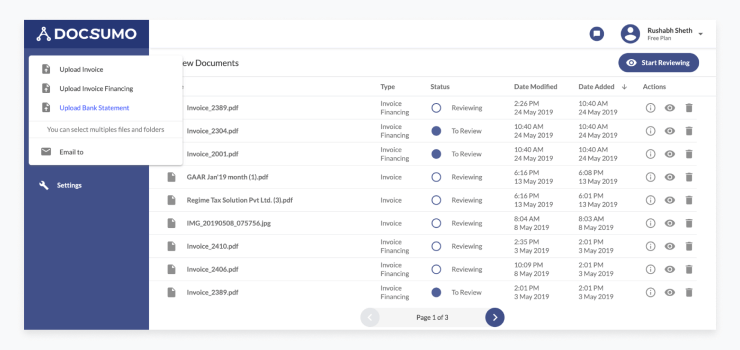

- Docsumo API: Uses OCR technology to convert unstructured documents into actionable information; can work with many types of documents in different formats, including scanned images and PDF files.

Read More: 10 Best AI-Powered OCR Tools for Accurate Data Extraction

Case Study:

As a white-label ATM provider, Hitachi faced significant challenges with monthly reconciliation of bank statements sent by ATM operators. Manual processing proved insufficient due to the increasing volume. By leveraging the Docsumo API, the company was able to process bank statements in less than 30 minutes with an accuracy rate exceeding 99%. The automation of the entire process significantly improved efficiency and accuracy.

What risks do FinTech APIs pose for the financial industry?

While fintech APIs offer numerous benefits, they also come with risks that need to be managed carefully. Let’s take a look at some of the key risks that the finance industry is up against:

Security vulnerabilities

Perhaps the most important risk is that of data security. fintech APIs, if not properly secured, can expose sensitive financial data to potential cyberattacks. Hackers may exploit weaknesses in API security to gain unauthorized access to personal information, financial transactions, and other confidential data, leading to financial loss and reputational damage.

Compliance and regulatory challenges

The use of fintech APIs must adhere to strict regulatory standards, such as GDPR and PSD2, depending on the countries they operate in. Non-compliance can lead to hefty fines, legal repercussions, and loss of trust from customers and partners. Maintaining compliance across different jurisdictions adds complexity to API management.

Integration complexity

Integrating multiple APIs from various providers can create significant software development complexity, potentially leading to issues with compatibility, performance, and reliability. Poorly managed integrations can result in system downtime, disrupted services, and a degraded user experience. It’s critical to work with an API development team that is experienced in setting up APIs properly from the start.

Dependency on third-party providers

Relying on third-party APIs can create dependencies that may pose risks if the provider experiences outages, changes their terms of service, or discontinues their API. This can disrupt business operations and require significant efforts to switch to alternative solutions or rebuild functionalities. Like the other risks, this is one that should be considered carefully as part of a broader tech stack strategy discussion.

Performance and scalability issues

Application programming interfaces must be robust and scalable to handle varying loads and ensure consistent performance. Any performance issues or lack of scalability can lead to slow response times, system crashes, and an inability to meet user demands, negatively impacting the user experience and business performance. It’s critical to properly vet and thoroughly test APIs before committing to their use.

Conclusion

Fintech APIs are revolutionizing the financial services industry by enabling seamless integration, enhancing operational efficiency, and fostering innovation. However, it is crucial to address the associated risks, such as security vulnerabilities and regulatory compliance, to ensure their successful implementation. By leveraging Fintech APIs effectively, financial institutions can provide enhanced services, improve customer experiences, and stay competitive in the rapidly evolving market.

Our team at SoftKraft provides financial software development services and API development services with a clear focus on your success. We'll use our experience to help you select the best APIs for your project and seamlessly integrate them into a robust, scalable solution. Reach out today for a free project quote.

![10 Dos and Don'ts - Financial App Development [2025 Guide]](/uploads/blog/financial-app-development/financial-app-development.png)