The number of open banking Application Programming Interface (API) calls is forecast to grow from 102 billion in 2023 to 580 billion in 2027, signaling rapid expansion and integration of open banking services globally. This surge highlights the profound impact open banking is having on the financial industry, enabling unprecedented levels of financial transparency and competition.

As this trend continues to gain momentum, understanding the practical applications of open banking APIs becomes crucial. In this article, we will explore the top 10 use cases of open banking APIs that are revolutionizing financial services and driving the future of fintech.

- What is open banking?

- Benefits of open banking APIs

- Top 10 Open Banking API Use Cases

- 1. Identity verification

- 2. Enable secure payment processing

- 3. Access customer financial data

- 4. Build personalized financial services

- 5. Create budgeting and savings tools

- 6. Streamline financial operations

- 7. Enhance fraud prevention

- 8. Offer loan and credit solutions

- 9. Provide financial education

- 10. Deliver new digital services

- Conclusion

What is open banking?

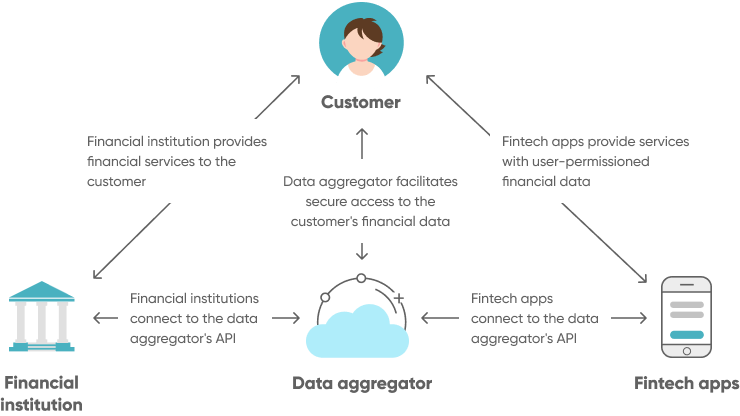

Open banking is a system that allows third-party financial service providers to access consumer banking information, such as transactions and account details, through the use of application programming interfaces (APIs). This system is designed to foster greater financial transparency and competition by enabling customers to securely share their banking data with other financial institutions and third-party service providers.

The global evolution of open banking adoption

Open banking has experienced significant growth and evolution, characterized by three distinct waves over the past decade:

Inception and Regulation (2015-2018): Open Banking originated in the United Kingdom with the implementation of the Revised Payment Services Directive (PSD2) by the European Union in 2018. This regulation mandated banks to open their payment services and customer data to third-party providers, fostering competition and innovation in financial services. The primary objective was to provide consumers with more control over their financial data, enhance transparency, and stimulate the development of new financial products and services.

Early Adoption and Expansion (2018-2020): Following the UK and EU's lead, other regions began exploring and implementing their own Open Banking frameworks. In Australia, the Consumer Data Right (CDR) was introduced to promote data sharing across various sectors, including banking. Countries like Singapore and Hong Kong also proactively established frameworks to support Open Banking. This phase saw significant voluntary adoption in the U.S., driven by market demand and competitive pressures, despite the absence of a regulatory mandate.

Global Integration and Innovation (2020-Present): The current phase, often referred to as open finance, extends open banking principles to a broader range of financial products, including savings accounts, mortgages, and insurance. This wave is also characterized by the participation of non-financial industries and evolving regulatory frameworks to accommodate these new use cases.

How do open banking APIs work?

Open banking APIs enable seamless and secure interactions between consumers, third-party providers, and banks. Here’s a step-by-step breakdown of how these APIs operate:

Step 1: Consumer consent

The process begins with the consumer granting consent to a third-party provider to access their banking data. This consent is typically obtained through a user interface where the consumer logs in to their bank account and approves the data access request. This step ensures that the consumer is fully aware of and agrees to the data sharing.

Step 2: API request

Once consent is secured, the third-party provider sends an API request to the bank’s API endpoint. This request includes an authorization token obtained during the consumer consent process, which serves as a digital key to access the consumer’s data.

Step 3: Authentication

The bank verifies the authorization token to confirm that the request is legitimate and comes from an authorized third-party provider. This step often involves additional security measures, such as Strong Customer Authentication (SCA), to further validate the request.

Step 4: Data retrieval or action execution

Upon successful authentication, the bank processes the API call. Depending on the nature of the request, the bank might:

- Retrieve and return the requested data, such as account balances, transaction histories, or customer details.

- Initiate an action, such as making a payment or setting up a direct debit.

Step 5: Response

The bank sends a response back to the third-party provider through the API. This response contains either the requested data or a confirmation of the completed action, ensuring the provider can proceed with delivering their service.

Step 6: Data usage

Finally, the third-party provider uses the retrieved data to deliver services to the consumer. We’ll go into detail on the types of services later in this article!

Benefits of open banking APIs

Now that we understand how open banking APIs function, let’s consider the key benefits that they pose to companies of all sizes.

Faster and safer online payments

Open Banking APIs enable faster and safer online payments by directly connecting consumers' bank accounts with merchants, reducing transaction times and eliminating intermediaries. Utilizing advanced authentication methods and standardized security protocols, these APIs enhance the security of digital transactions, significantly lowering the risk of fraud and unauthorized access.

Increased competition and innovation

Open banking APIs foster a competitive financial landscape. By allowing new entrants and smaller fintech companies to access financial data and services, competition increases, driving innovation. This leads to the development of novel and improved financial products and services that better meet consumer needs, resulting in a more dynamic and responsive financial sector.

Enhanced security and data control

Open banking APIs prioritize security and data protection. By utilizing standardized security protocols and requiring customer consent for data sharing, these APIs ensure that consumers have greater control over their personal information, reducing the risk of unauthorized access and enhancing overall data security.

Top 10 Open Banking API Use Cases

Open banking APIs are transforming the financial services landscape by enabling innovative applications and services. Here are the top 10 use cases demonstrating how these APIs are revolutionizing banking, from enhancing security to improving customer experiences.

Identity verification

Let’s start by looking at the original and most core use case of open banking: identity verification. The reason this was such a fundamental use case was due to the nature of the customer data that banks hold. To open and maintain a bank account, customers have to go through a lengthy identification process and typically will be sure to update their data in a timely manner.

This provides a real value for other entities to leverage this kind of identity verification. When a user consents to share their banking information, an open banking API retrieves data such as account ownership details, transaction history, and personal information directly from the bank. This can then be used as a proxy identity verification. The exact mechanism for achieving this identification depends on the regulations in a particular county.

Examples of APIs for identity verification:

- Plaid Identity: Facilitates seamless account verification by directly connecting merchants to consumer bank accounts, allowing retrieval and verification of information such as account and routing numbers.

- TrueLayer’s Identification API: Enables digital authentication for third-party providers, allowing secure data sharing or payments based on customer-provided details like name, address, and contact information.

- Yodlee: Leverages regulated bank APIs to offer a secure and efficient method for obtaining and validating customer information.

Case Study:

Poland's government is leading the way in digital innovation by digitizing many of its processes. However, this effort requires initial identity verification, which traditionally involves citizens physically visiting a government office to present their identifying information.

To overcome this hurdle and advance their digitization initiative, the Polish government collaborated with banks to leverage the pre-verified identities of bank clients. This collaboration allows bank customers to quickly and digitally verify their identity by logging into their bank account, thereby enabling them to participate in the new Trusted Profile system without ever having to go into a physical office.

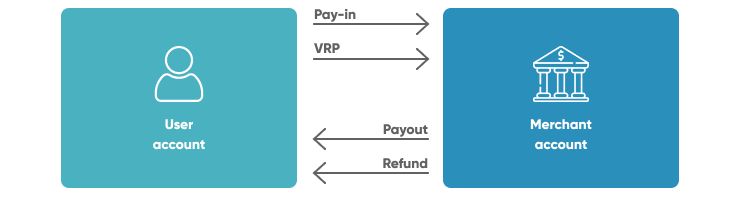

Enable secure payment processing

Open banking APIs are revolutionizing the way payments are processed by enabling direct transactions from bank accounts, thus providing a more secure and seamless experience compared to traditional methods like screen scraping. With APIs, third-party providers, including payment initiation service providers, can initiate payments on behalf of users, ensuring that sensitive financial data is handled securely and efficiently.

This not only enhances user trust but also reduces the risk of fraud and data breaches, as the API connections are encrypted and authorized by the user through robust authentication mechanisms like OAuth 2.0 and Strong Customer Authentication (SCA).

One of the most significant advancements in this space is Variable Recurring Payments (VRPs). Unlike one-time payments, VRPs are designed for complex payment scenarios where the amount and frequency of payments can vary. This flexibility is crucial for services like utility bills, subscriptions, and other recurring expenses that do not have a fixed payment amount.

Examples of APIs for secure payment processing:

- Plaid Payment API: Allows developers to build applications that can initiate bank transfers directly from users' bank accounts.

- TrueLayer Payments API: Provides a secure way to initiate payments in the UK and EU, ensuring compliance with PSD2 regulations, and offering features like instant settlement and lower transaction fees.

- Token REST API: Offers an API along with a comprehensive platform for payment processing, enabling direct bank payments with high security and regulatory compliance.

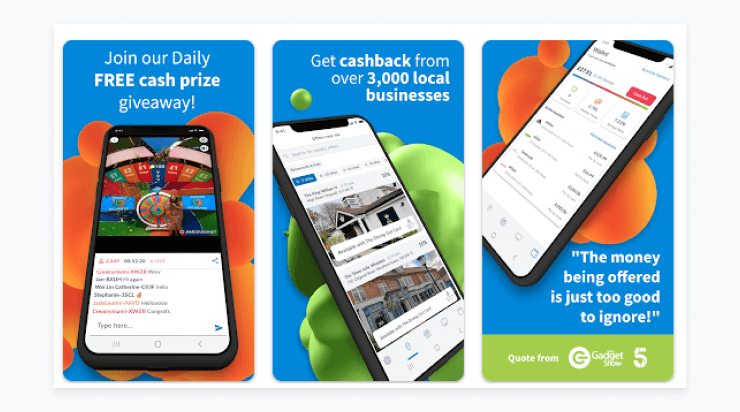

Case study:

JamDoughnut allows customers to earn cashback or reward points with thousands of UK businesses. JamDoughnut has large payment volumes, with roughly one transaction per second. JamDoughnut leverages TrueLayer API to offer a ‘pay by bank’ payment option, currently processing 90% of their payments. The API is used not just as part of the checkout experience but also to handle refunds.

Access customer financial data

Open banking APIs can also be used to securely retrieve information such as account balances, transaction histories, and spending patterns with the user's explicit consent. This access to real-time and detailed financial data allows the financial services industry to create personalized financial management applications, budgeting tools, and investment advisory services.This capability transforms the financial services landscape, enabling more informed decision-making and better financial planning for consumers.

Examples of APIs to access financial data:

A number of open banking platforms have hit the market that offer a “one-stop-shop” to access a multitude of financial institution data. Essentially, these platforms allow you to bypass the work of connecting with individual bank APIs and instead build on top of a system that can connect to virtually any bank. Options such as:

- Plaid API: Provides access to over 12,000 data providers through a single interface, allowing developers to retrieve account information, transaction history, and other financial data.

- Finicity by Mastercard: Offers open banking solutions that provide consumer-permissioned financial data, enabling secure data exchange among banks, fintech firms, and third-party providers in real-time

- TrueLayer Data API: Ensures secure access to account information and transaction history, helping developers build innovative financial tools that enhance user experience.

Case study:

The Monarch Money budgeting app utilizes open banking APIs like Plaid, Finicity, and MX to aggregate financial data from a user’s multiple bank accounts, providing insights into spending habits and suggesting ways to save money. By leveraging these APIs, Monarch Money not only ensures seamless and secure data integration but also offers personalized financial advice, helping users achieve their financial goals with greater efficiency and confidence.

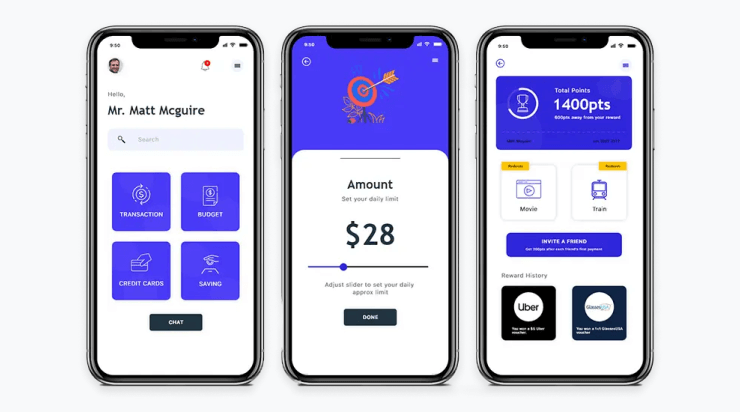

Build personalized financial services

One of the key applications of accessing financial data is to build personalized financial services with the help of individual customer data. This level of personalization was simply not possible before access to real-time banking data via open banking APIs. By accessing detailed financial data with the user's consent, developers can analyze spending habits, income patterns, and savings goals to offer customized financial solutions. This personalized approach enhances the user experience, making financial management more relevant and effective for individual consumers.

Examples of APIs for building personalized financial services:

- Finicity by Mastercard: Allows developers to access consumer financial accounts to create customized budgeting, savings, and financial wellness tools.

- MX API: Provides rich financial data insights that help developers build personalized financial management applications, offering features like transaction categorization and predictive analytics.

- Bud API: Enables the creation of tailored financial products by aggregating and analyzing user data, helping developers offer personalized financial advice and product recommendations.

Case study:

Cleo, a personal finance app, uses open banking APIs along with AI technology to provide personalized budgeting advice and financial insights based on users’ transaction data and spending habits. By combining these technologies, Cleo can deliver real-time financial tips and alerts, empowering users to make smarter financial decisions and maintain better control over their finances.

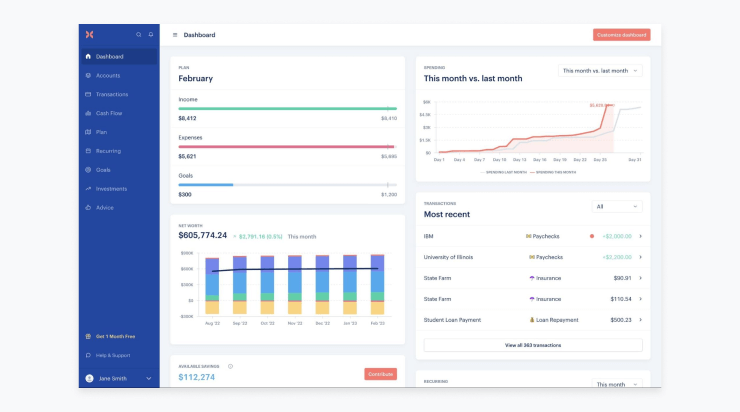

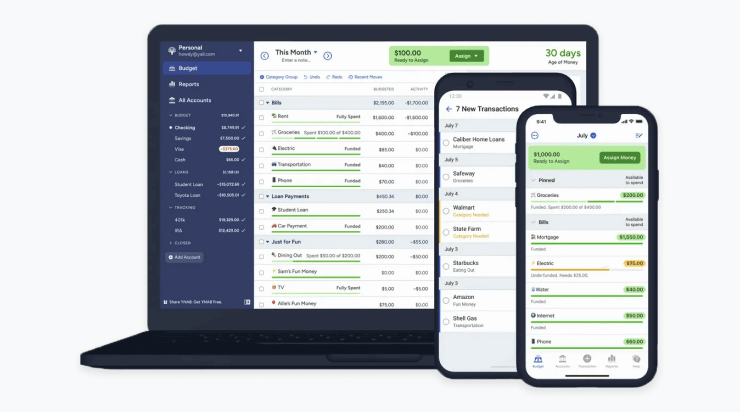

Create budgeting and savings tools

A whole range of mobile budgeting and savings apps have popped up in recent years thanks to open banking APIs.These tools compete with traditional banking services to provide personalized insights and recommendations, helping users manage their finances more effectively. For example, a budgeting app can categorize expenses, generate monthly spending reports, and send alerts when budgets are exceeded. Savings tools can suggest savings goals and automate transfers based on income and spending patterns. Investment apps can offer personalized strategies aligned with user goals.

The requirements for these APIs will be similar to those that are being used to access general financial data such as transactions, balances, etc.

Examples of APIs that can be used to build budgeting and savings tools:

- Plaid API: Provides access to a wide range of financial data, enabling detailed transaction categorization and personalized financial insights.

- Tink by Visa: Has over 6000 connections to European banking industry institutions, and offers enriched and categorized financial data.

- Yapily: Europe’s largest open banking platform with 2,000+ bank integrations, providing real-time financial information for budgeting and savings.

Case study:

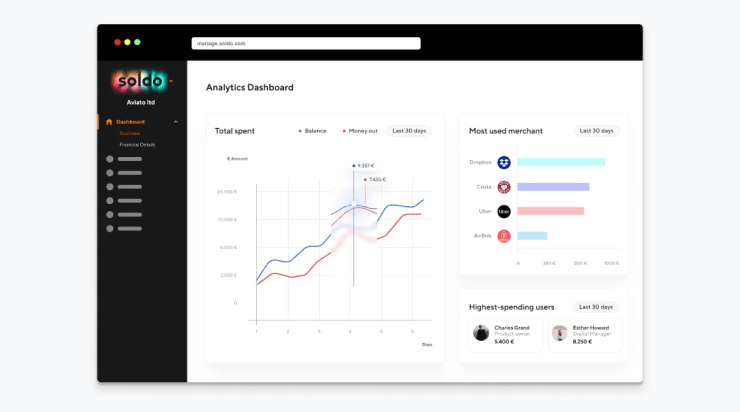

Soldo leveraged Yapily API to build a decentralized spend management platform to help businesses manage their decentralized spending. This innovative platform allows businesses to allocate budgets, track expenses in real-time, and gain comprehensive insights into their financial activities, ultimately improving financial control and efficiency across the organization.

Streamline financial operations

Open banking APIs provide a robust framework for automating and streamlining financial operations, significantly reducing the administrative burden on businesses. By leveraging these APIs, developers can automate tedious tasks for financial institutions such as accounting, invoicing, and reconciliation, freeing up valuable time for finance and operations teams to focus on strategic activities.

Examples of APIs for streamlining financial operations:

- Xero API: Integrates seamlessly with a customer’s bank account to automate a wide range of accounting tasks. From bank reconciliation to expense tracking, Xero helps businesses maintain up-to-date financial records with minimal manual intervention.

- QuickBooks API: QuickBooks’ API connects with various banking platforms, enabling businesses to automate financial processes such as transaction categorization, invoice generation, and comprehensive financial reporting, thus simplifying financial management.

- Stripe Connect API: Stripe’s API offers a unified platform for managing payments, billing, and financial reporting. By automating these processes, businesses can reduce administrative overhead, improve cash flow management, and gain valuable insights into their financial health.

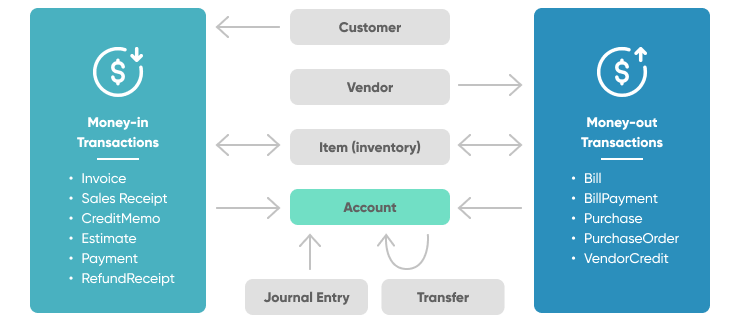

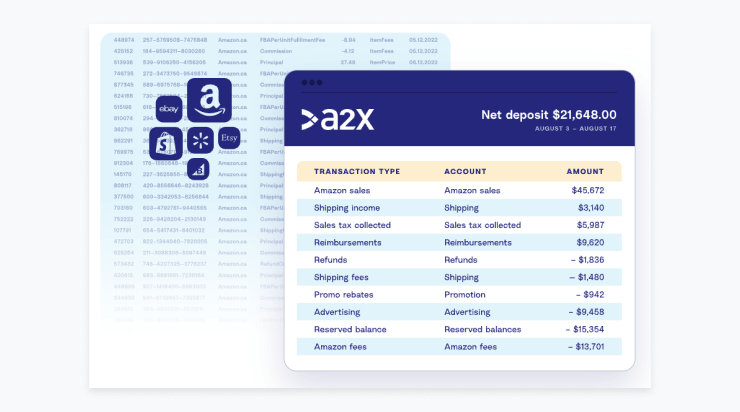

Case study:

Xero’s API and app ecosystem provided support to the e-commerce accounting SaaS startup A2X. The use of the AI allows A2X to automatically post ecommerce sales and fees into Xero to help customers simplify their reconciliation process and be more confident that everything has been accounted for.

Enhance fraud prevention

Open banking APIs empower developers to enhance fraud prevention by providing real-time access to transactional data for immediate analysis and detection of suspicious activities. By integrating these APIs, financial institutions can monitor transactions continuously, identify unusual patterns, and swiftly mitigate potential fraud, significantly enhancing transaction security.

While many of the more general financial transaction and banking data APIs we’ve looked at above could be used to build fraud detection features or services, there are also some more specific APIs that exist to support compliance with Know Your Customer (KYC) and Know Your Business (KYB) regulations and even others that leverage algorithms and AI to detect fraud. Whether you’re looking to access a fraud detection service API or a general API that provides data will dictate which solution will be best for your application.

Examples of APIs for fraud prevention:

- Trulioo KYC API: Enables businesses to verify customer identities by checking against global data sources, ensuring compliance with regulations

- Trulioo KYB API: Allows businesses to verify the legitimacy of other businesses by accessing company information, ownership details, and more.

- Sift API: Utilizes machine learning to analyze transaction data, detect fraudulent activities, and provide real-time fraud prevention solutions.

- Fidel API: Provides real-time transaction data to detect and prevent fraudulent activities by monitoring card transactions and identifying unusual patterns.

Case study:

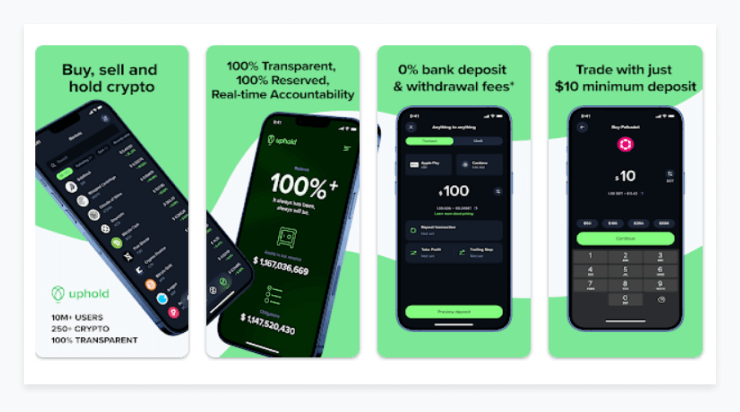

Uphold, a multi-asset digital money platform uses Sift API to lower fraud rates to %0.01. Sift Payment Protection and Account Defense products integrated with Uphold’s existing systems and allowed them to secure key points in their customer journey—account creation and the subsequent transactions that took place on their platform.

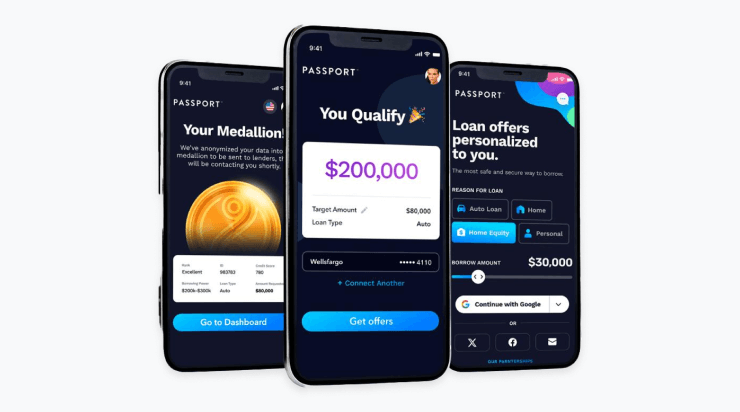

Offer loan and credit solutions

By accessing real-time financial data, lenders can gain a comprehensive view of an applicant's financial health, including transactions, balance history, income, spending habits, and recurring payments. This detailed insight allows for more accurate risk assessment and personalized loan offers, improving both the approval process and customer satisfaction.

Some APIs exist to provide direct access to credit scores, while others provide more general financial data that can be used to assess credit worthiness.

Examples of APIs for offering loan and credit solutions:

- Experian API: Uses financial data to provide comprehensive credit reports and scores, helping lenders assess risk more accurately.

- CRS API: Provides an all-in-one credit data API solution for businesses, offering Equifax, Experian, and TransUnion credit reports, along with public records and alternative data.

- Finicity Lending API: Offers an open banking platform with APIs that allow access to consumer-permissioned financial data from over 10,000 institutions.

- Equifax API: Offers APIs for accessing consumer credit data, alternative data, and real-time analytics. These APIs help businesses make informed decisions and streamline processes.

- MX Loan Origination and Processing: Provides lenders with real-time insights and additional information beyond traditional credit scores. It enhances loan origination processes, minimizes risk, and speeds up loan approvals.

Case study:

FormFree’s mission is to create a better home buying process by enabling creditors to understand a person’s ability and willingness to pay. FormFree leverages MX’s API to automate lenders verification of applicants’ identity, assets, income and employment. It has helped lenders calculate, verify and quantify what consumers can afford for over $2 trillion in mortgage loans.

Provide financial education

An open banking API can enable developers to create educational resources and financial literacy tools that help customers enhance their financial knowledge and make informed decisions. By accessing real-time financial data, these tools can deliver personalized insights and practical advice, guiding users through complex financial topics such as budgeting, saving, investing, and credit management.

For example, a financial education app can use open banking APIs to analyze a user's spending habits and provide tailored tips on how to reduce expenses and increase savings. Or, credit education platforms can use transaction data to offer personalized advice on improving credit scores and managing debt.

Examples of APIs for providing financial education:

- Plaid API: Provides secure access to users' bank account data, including transaction history, account balances, and spending patterns that could then be used to develop financial education apps.

- Tink by Visa: Open banking platform that enables financial institutions, fintechs, and merchants to build tailored financial management tools, products, and services for European consumers and businesses based on their financial data.

- MX API: Provides secure access to detailed financial data, including transactions, account balances, and spending trends, enabling apps to deliver personalized financial education.

Case study:

YNAB integrates with Plaid via API to offer detailed transaction categorization and personalized budgeting insights. By connecting with bank accounts for real-time updates and detailed financial reports, YNAB helps users gain control over their finances and develop healthier money habits.

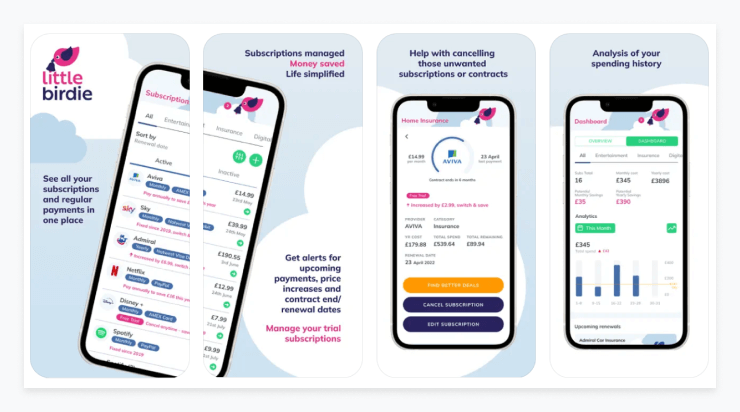

Deliver new digital services

Open banking APIs, much like AI, are enabling a wave of innovative products and services that were previously unimaginable. These APIs open up vast opportunities for crossover with AI and present novel ways to leverage data that was once inaccessible. Some examples of new digital services include:

- Financial chatbots: Provide real-time account information, assist with fund transfers, and offer personalized budgeting tips based on transaction history.

- Virtual assistants: Schedule bill payments, set up alerts for unusual transactions, and provide tailored investment advice.

- AI-powered expense trackers: Analyze spending patterns and suggest ways to save money or optimize spending.

- Automated savings tools: Transfer surplus funds to savings accounts based on income and expense analysis.

- Personalized loan and credit offers: Assess creditworthiness using real-time financial data to offer customized loan products.

- Investment advisory services: Use financial data to recommend investment strategies tailored to individual goals.

- Voice-activated banking services: Enable users to perform banking tasks through voice commands, integrating with platforms like Alexa and Google Assistant.

For these types of applications, developers often blend open banking APIs with other advanced technologies such as AI, machine learning, voice recognition, and natural language processing to create innovative, customer-focused products.

Case study:

Little Birdie addresses the problem of wasted money on unused subscriptions with a subscription and bill management app for UK customers. Bud's AI-powered data intelligence platform identifies and categorizes recurring payments so that consumers can cancel or switch to a better deal.

Conclusion

Open banking APIs are revolutionizing the financial services industry by enabling a plethora of innovative use cases that enhance security, efficiency, and customer experience. From identity verification and secure payment processing to building personalized financial services and integrating with third-party systems, these APIs offer immense potential for fintech leaders to create value-driven solutions. As the open banking landscape continues to evolve, staying informed about these use cases is crucial for leveraging the full benefits of this transformative technology.

If you’re looking for a development team to bring your financial app vision to life, we’d love to help. We offer financial software development services that simplify the implementation process, enabling you to achieve business results without the hassle. Our team will guide you in selecting the right technologies, planning development, and building an end-to-end solution that perfectly aligns with your business requirements. Contact us.

![10 Dos and Don'ts - Financial App Development [2025 Guide]](/uploads/blog/financial-app-development/financial-app-development.png)