Harnessing the power of real estate data analytics can enable you to close more deals, improve profit margins, and reduce investment risks. However, navigating multiple data sources and ensuring data accuracy can pose significant challenges.

In this article, we’ll cover 7 practical ways to leverage real estate software data, the essential metrics to consider, and the top technologies you can start using right away.

Real estate data analytics basics

The primary goal of real estate data analytics is to extract meaningful insights from large sets of data to inform strategic decision-making, optimize operational efficiency, and maximize profitability in the real estate industry. Practically, this will involve using one of the four following strategies:

- Manual data analysis: This is the traditional approach where data is manually scrutinized. It could involve perusing property listings on real estate websites, comparing sale prices, or reviewing property features. It's often time-consuming and difficult to do at scale.

- Home-grown, automated data analysis: This method is a step up from manual analysis. By integrating property data into tools like Excel or Google Sheets, users can set up automatic calculations. For instance, given property rates and areas, you can create a formula to automatically calculate potential ROI.

- Off-the-shelf data analytics software: These are specialized tools built for real estate data analysis. They often come equipped with features to pull data from public sources, visualize insights, and even predict market trends based on historical data.

- Custom solution/real estate data APIs: For large real estate enterprises or tech-savvy realtors aiming for the cutting edge, custom solutions are the way to go. By tapping into real estate APIs, businesses can access vast datasets, ranging from property valuations, historical sales data, and even potential buyer demographics. This big data can be integrated with in-house data to create tools fine-tuned to specific business needs.

Benefits of real estate data analytics

By leveraging data-driven insights, real estate agents, investors, and other professionals in the industry can expect the following key benefits:

- Informed decision-making: With advanced data analytics, stakeholders can make decisions based on data, not just intuition. This covers everything from choosing which properties to buy or sell, to setting appropriate rental rates, to deciding when to invest in renovations.

- Risk mitigation: By analyzing market trends, historical data, and predictive indicators, investors and property owners can identify potential risks and better protect against financial loss.

- Improved accuracy: Predictive analytics and machine learning can provide more precise property valuations and rental price estimations.

- Identifying investment opportunities: Real estate data analysis at scale can identify high-growth areas, demographic shifts, and other factors that signal profitable investment opportunities.

7 Ways to use data for better real estate deals

In this section, we’ll provide 7 tangible ways that real estate teams can start leveraging data for better deals. Use this list as a starting point for building a strategy to meet your own unique business goals.

Dive deeper into MLS data

For real estate agents and professionals eager to delve into data analysis, beginning with MLS data can be a great option. Most agents are already acquainted with MLS as a daily tool, making it an ideal starting point for further exploration. While there are many angles to take when reviewing MLS data, here are a few ideas to get started:

- Market trend analysis: Examine past listing prices, selling prices, and days on the market to identify trends

- Price forecasting: By examining the past price trends in the MLS data, one can begin predicting if prices in a certain area are likely to rise, fall, or remain stable. This helps both buyers and sellers in making informed decisions.

- Inventory analysis: This focuses on the supply side of the real estate equation, which is crucial to understand the dynamics of demand and supply.

- Days on market (DOM): This statistic tells investors how long a property has been on the market in its current listing period. If a property has been on the market for a long time, it might suggest that it is overpriced or there are issues with the property.

- Rental income data: If available, data on potential rental income can be crucial for investors interested in buying rental properties.

Now, consider how you can systematically analyze this data at scale. Maybe you want to build a simple, custom software solution that alerts you when new properties hit the market that meet certain criteria. Or, maybe you want to help your clients get a better deal by using historical data to predict the sales price of a particular property. There is so much data available in the MLS, and when you have a well-defined data strategy, you can use it to improve your real estate business.

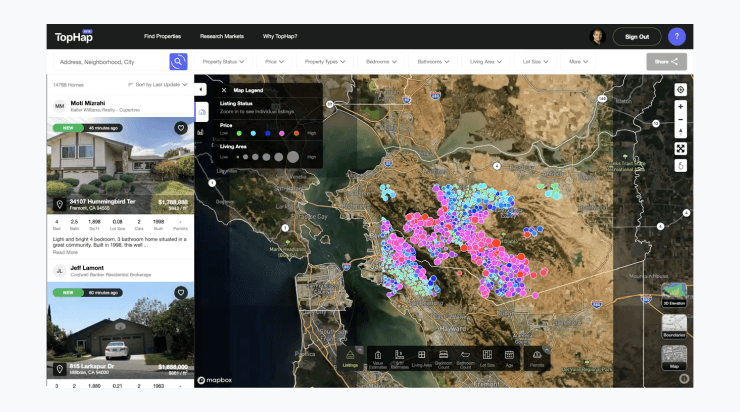

PRO TIP: A software tool like TopHap can make the visualization and understanding of this data more intuitive and straightforward, especially those just getting started with more advanced data analysis.

We particularly like the visual map layers that enable you to uncover insights about regions, neighborhoods, properties and lots in seconds.

Supply & demand analysis

Supply and demand is what drives real estate markets. At a high level, it’s what determines the prices that properties sell for - the lower the supply, the higher the demand (and the higher the price). For this reason, understanding supply and demand dynamics can help level up your effectiveness in this industry and help you to:

- Refine listing prices: By coupling traditional comps with real-time supply and demand metrics, real estate professionals can set listing prices that are more aligned with current market dynamics, ensuring neither underpricing nor overpricing the property.

- Set rent prices: Landlords and property managers can utilize supply and demand analysis to effectively set rent prices. In high demand, low supply areas, higher rents can often be charged, while an oversupply may necessitate more competitive pricing.

- Avoid oversaturated markets: Investors can use supply and demand metrics to steer clear of oversaturated markets where high supply and low demand could lead to lower returns and longer times to sell or rent properties.

- Spot potential opportunities: Investors can use supply and demand insights to identify markets where demand outstrips supply, signaling potential investment opportunities. These markets often offer high potential for value appreciation and strong rental demand.

PRO TIP: Combining supply and demand analysis with other forms of real estate data can uncover unique investment opportunities not readily visible on the market. For instance, consider properties in high-demand areas where the supply is consistently low.

By analyzing data such as the length of ownership, property condition, and owner's demographic information, you can identify properties that aren't currently for sale but whose owners might be amenable to offers. This strategy, often referred to as 'off-market prospecting,' requires thorough data analysis but can lead to lucrative deals in competitive markets, offering potential for better negotiation power and less competition.

Identify investment opportunities

Often investors spend a lot of time manually searching through properties online and making ROI calculations in order to identify the right investment opportunities. Leveraging data engineering can help real estate companies to identify potential investment opportunities much faster, as it allows them to discern patterns and trends in the market that might otherwise remain hidden.

Specifically, thorough data analytics in this area can help investors to:

- Spot regions or property types with high demand but limited supply, signaling potential investment opportunities.

- Analyze market trends and fluctuations to anticipate future property hotspots or potential investment risks.

- Identify investment risks at a granular level, such as specific risks associated with a property, location, or market conditions.

- Conduct opportunity/risk assessments before committing to building a new property, ensuring that the potential returns justify the investment.

- Perform opportunity/risk assessments before investing in property renovations, determining whether the anticipated increase in property value outweighs the cost and effort of the renovation.

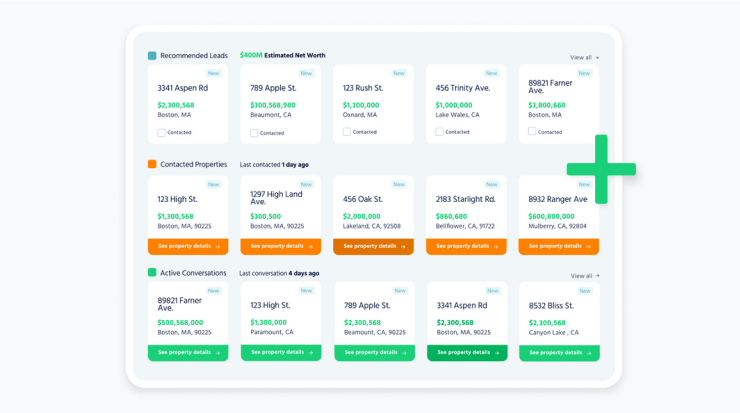

PRO TIP: There are many niche tools on the market to help you in this area. For example, consider a tool like Catalyze AI, which uses AI and machine learning to identify and generate leads related to inherited property.

The company collects and analyzes data from public records, social media, obituaries, and other sources to find potential sellers who have inherited a property from a deceased relative. Catalyze AI then contacts these leads via email, text, or phone and offers them a free consultation and valuation of their property.

Accurately calculate property value

Accurately calculating property value is a crucial aspect of real estate management. By utilizing data-driven methodologies, you can determine the fair and market-based value of a property. This enables you to make informed decisions when buying or selling properties, negotiating deals, or assessing the overall performance of real estate assets. A few ways to improve the accuracy of your property valuation calculations are:

- Conduct a comparative market analysis by comparing the subject property with similar properties in the area that have recently sold. Analyze key factors like property size, condition, location, and recent sale prices to estimate the value of the subject property.

- Use automated valuation models (AVMs), which leverage algorithms and historical sales data to provide automated property valuations. These models analyze various data points to estimate property values in the personal and commercial real estate market.

- Apply traditional appraisal methods such as the Sales Comparison Approach, Income Approach, or Cost Approach, depending on the property type and purpose of the valuation. These methods involve analyzing relevant data and making adjustments based on market factors, income potential, and property condition.

PRO TIP: Integrating with valuation APIs like Zillow's offers real-time insights into property valuations. It provides access to the Zestimate — Zillow's estimated market value—as well as a wealth of other valuation-related data such as comparable homes, valuation range, and historical estimates.

By tapping into these APIs, real estate professionals can enhance their property valuation strategies, seamlessly pulling in extensive market data and analytics.

Read More: 10 Proven Real Estate APIs That Deliver Unrivaled Market Insights

Conduct rental profitability analysis

Conducting rental profitability evaluations using real estate data analytics can provide valuable insights for property owners and investors. This evaluation allows you to assess the financial performance of rental properties, analyze the potential profitability, and make data-driven decisions regarding rental pricing and investment strategies. A few pieces of data you should consider evaluating to conduct a thorough profitability analysis include:

- Rental income: Understanding the potential revenue from the property is foundational. Research similar properties in the same area to get a realistic estimate of potential rental income.

- Operating expenses: This includes costs like taxes, insurance, property management fees, maintenance costs, and potential vacancy periods. Accurate calculation of these costs is essential to understand the profitability of the property.

- Financing costs: If the property is purchased using a mortgage, the cost of the loan, including interest payments, will significantly impact profitability.

- Capitalization rate (Cap Rate): This key real estate investing metric offers a quick snapshot of potential return, providing a ratio of the net operating income to the property’s market value. A higher cap rate suggests a higher potential return and vice versa.

- Cash-on-cash return (CoC): This metric measures the annual return the investor made on the property in relation to the amount of mortgage paid during the same year. It's calculated by dividing the cash flow before tax over the equity invested.

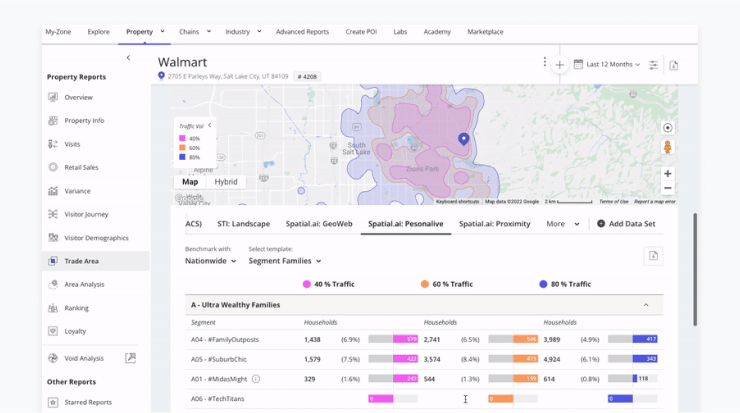

PRO TIP: Placer.ai offers invaluable insights for commercial real estate investors and professionals by analyzing anonymized location data from millions of mobile devices. This real-time location intelligence can provide a deeper understanding of foot traffic patterns and consumer behavior near a property.

For those looking to invest in or price commercial rentals, these insights can significantly influence decisions, as properties with higher foot traffic might command higher rents. By leveraging Placer.ai, you can optimize site selection, negotiate better lease terms, and ensure your property aligns with market trends and demands.

Create automated market reports

Creating automated market reports using real estate data analytics can be a game-changer for staying informed and making data-driven decisions in the dynamic real estate industry. By automating the process of generating market reports, you can save time, enhance accuracy, and keep stakeholders up-to-date with key market trends and insights. Here's a guide to help you start creating automated market reports using real estate data analytics:

- Identify key market metrics: Determine the essential market metrics you want to include in your reports, such as average home prices, days on market, inventory levels, sales volume, and other relevant indicators specific to your target market.

- Access reliable data sources: Identify reliable data sources that provide accurate and up-to-date market data, such as local real estate boards, MLS platforms, government reports, and real estate data providers. Ensure the data you access is comprehensive and covers the areas and property types you are interested in.

- Define report parameters and frequency: Determine the specific parameters and filters for your market reports, such as geographical regions, property types, and timeframes. Decide on the frequency of report generation, whether it's daily, weekly, monthly, or as needed.

- Design and customize reports: Design visually appealing and user-friendly report templates that present the data in a clear and concise manner. Customize the reports to align with your branding and specific reporting requirements.

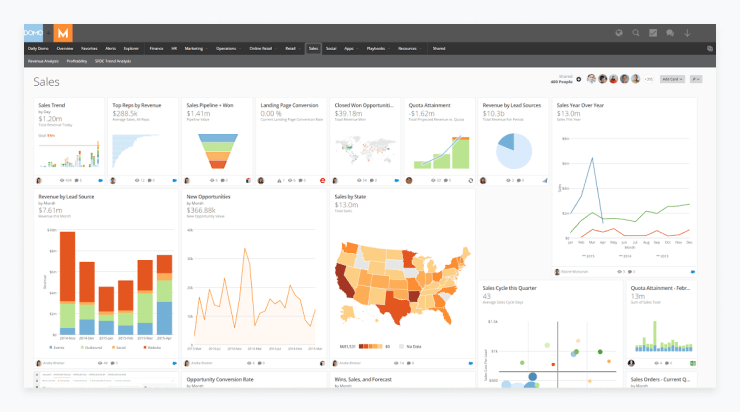

PRO TIP: Finding the right data visualization and reporting tool can be a challenge. You might consider:

- DOMO if you are looking for a robust, generic data visualization platform that can be built out and customized with the help of a data analytics expert or developer.

- TopHap if you are looking for a more out-of-the-box solution to get you started with basic real estate data analytics and reporting.

- Custom solution (or semi-custom solution) built to your specifications using open APIs to pull in real estate data from multiple sources.

Identify buyer portfolios

Identifying buyer portfolios using real estate data analytics can provide valuable insights for real estate professionals to tailor their marketing strategies and effectively target potential buyers. By analyzing demographic data, preferences, and buying behaviors, you can create buyer profiles that help you understand your target audience and align your marketing efforts accordingly. Here's a guide to help you start identifying buyer portfolios using real estate data analytics:

- Gather demographic data: Collect demographic data such as age, income levels, education, occupation, and household size. This data can be obtained from public records, census data, or third-party data providers.

- Analyze market segmentation: Analyze the market to identify specific segments based on property preferences, lifestyle choices, and purchasing behavior. Look for patterns and trends in the data to identify distinct buyer groups.

- Evaluate buying behavior: Study historical transaction data to understand buying behavior patterns, such as preferred property types, price ranges, location preferences, and specific amenities or features that buyers are looking for.

- Create buyer profiles: Based on the gathered data and analysis, create buyer profiles or personas that represent your target audience. These profiles should include key demographic information, preferences, and motivations.

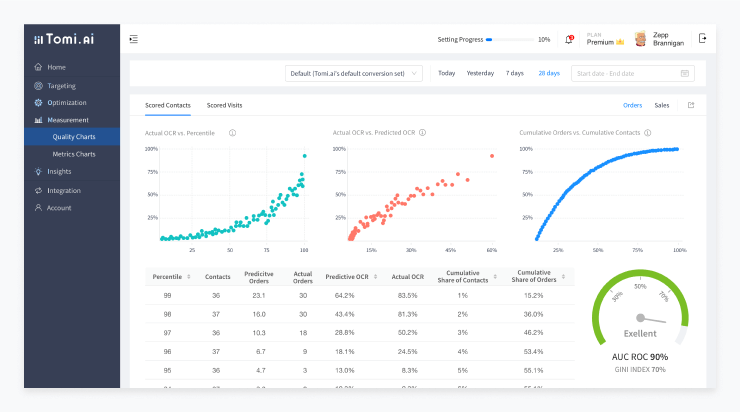

PRO TIP: Once you have identified buyer profiles, consider using a tool like Tomi.ai to target these potential buyers more effectively. It uses AI and machine learning to optimize ad spend for real estate agents and brokers. The company analyzes data from multiple sources, such as Google Ads, Facebook Ads, Zillow, Realtor.com, and others, to determine the best keywords, audiences, channels, and budgets for each campaign.

Conclusion

By intelligently leveraging data analytics real estate professionals can gain an edge in identifying valuable opportunities and optimizing their strategies for maximum ROI.

Embracing these data-driven methods not only ensures better deals but also equips agents, investors, and firms with the tools to thrive in an increasingly competitive market. It's not just about amassing data, but about harnessing its true potential for actionable insights and business growth.

SoftKraft team is experienced in working with real estate APIs as well as web scraping real estate portals to help you maximize your ROI. Leverage our extensive expertise in real estate software development to harness the power of real estate data, make better investment decisions, or even build a bespoke PropTech software solution. Check our work and reach out for a free quote!

![What is PropTech? 2025 Guide [+15 Fastest-Growing Startups]](/uploads/blog/what-is-proptech/what-is-proptech.png)

![Top 7 Smart Building Software Solutions [2025 Review]](/uploads/blog/smart-building-software/smart-building-software.png)