The rapid advancements in blockchain and AI-driven analysis are revolutionizing the financial industry, creating unprecedented opportunities for innovation. As a result, finance companies are increasingly seeking robust, agile, and sophisticated software solutions to address evolving regulatory challenges, enhance operational efficiency, and deliver personalized customer experiences.

In this article, we’ll look at the 7 key software development trends we’re seeing in 2025 in the finance sector. Use this guide to stay ahead of the curve, ensuring your strategies are aligned with the latest innovations that are shaping the future of finance.

The role of IT and software development for the finance sector

In the finance sector, custom software development plays a vital role in enhancing operations. It helps organizations improve data analytics, decision-making, and customer engagement while ensuring adherence to security and regulatory standards. Technological advancements like blockchain, AI, and cloud computing have significantly boosted transaction efficiency, transparency, and security.

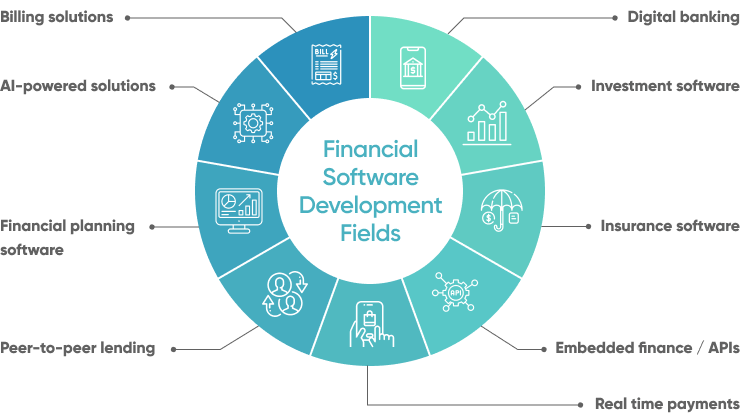

The breadth of the finance sector enables an equally wide range of software development applications, including:

Embracing these technologies reflects a commitment to future growth, making IT and software development essential for maintaining competitiveness in the finance sector. As we move forward, their importance will continue to shape the direction of financial services in a digital-driven world.

Challenges in adopting new technologies in finance

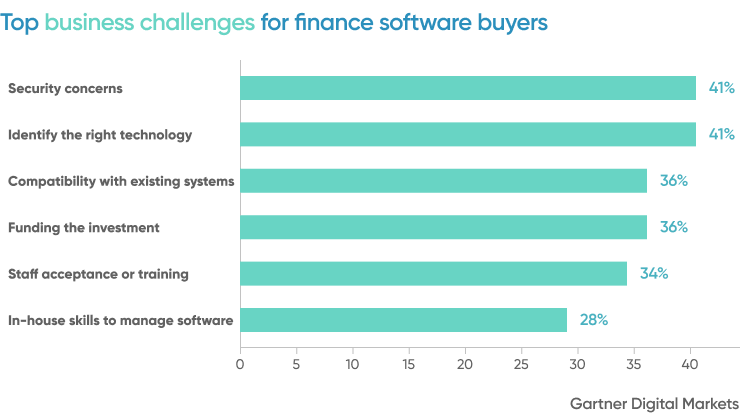

The integration of new financial software systems into existing financial systems is a strategic imperative for companies looking to maintain a competitive edge. Yet, it's not without its challenges. A Gartner Digital Markets survey has shed light on the primary hurdles finance software buyers face when acquiring financial software:

These concerns, among others, illustrate the delicate balance financial services companies must strike as they embark on a custom financial software development process, purchase software solutions, and integrate new technologies - all while safeguarding their operations. Key highlights include:

- Security concerns: In the finance industry, where data breaches can have catastrophic consequences, security is paramount. The challenge lies in integrating new technologies that not only advance capabilities but also maintain, if not enhance, the fortress of security that guards sensitive client data and financial transactions. This is where secure financial software plays a crucial role. It serves as the backbone of operations, providing a robust platform for managing and safeguarding financial data.

- Identifying the right technology: With a myriad of emerging technologies vying for attention, selecting the most appropriate one that promises value and aligns with business goals and financial processes is a significant hurdle. Making the right choice requires a deep understanding of both the technology and the business context.

- Compatibility with existing systems: The incorporation of new technology must be smooth and non-disruptive to current operations. Finance companies often face the arduous task of modernizing legacy applications and ensuring it doesn’t cause operational hiccups or require extensive re-engineering.

- Funding the investment: Accurately estimating software development costs, particularly AI development costs can be a real challenge. Without proper estimates it can be hard to secure funding for such investments, especially when the return on investment is long-term and indirect.

Financial software development in 2025

As we look toward 2025, the finance sector stands on the brink of further transformative changes, driven in part by rapid advancements in AI and increased demand by consumers for personalized, convenient services.

In this section we take a closer look at 7 of the key emerging trends in financial software development that are reshaping the financial software development services landscape.

AI-powered product personalization

AI-powered product personalization in the finance industry represents a revolutionary shift towards more customer-centric services and offerings. By leveraging artificial intelligence, financial institutions can now analyze vast amounts of data in real-time to understand individual customer behaviors, preferences, and needs.

This deep, data-driven insight enables banks, investment firms, and insurance companies, among others, to tailor their products and services to meet the unique requirements of each customer, enhancing satisfaction and engagement. Some examples of this at play include:

- Chatbots like Bank of America's 'Erica' use AI to provide personalized financial guidance, demonstrating the move towards more engaging and customized customer support.

- Platforms like the Cleo App analyze customer data to offer bespoke financial products and advice, catering to individual preferences and needs.

- Tools like Zbrain offer financial companies a way to provide AI-powered, target product recommendations.

Increased investments in IT security

In recent years, finance companies have been facing an escalating threat landscape that has significantly impacted their operations and customer trust. According to the Federal Trade Commission, US consumers reported losing more than $10 billion to fraud in 2023 - the first time that fraud losses have reached that benchmark. Similarly, the amount of fraud committed in the UK more than doubled to £2.3bn in 2023, marking the second-biggest year for scams in the last two decades

These financial crimes encompass a broad spectrum of illegal activities, including account creation and access fraud, investment fraud, business email compromise, and phishing, all of which have heavily targeted financial companies.

Consequently, there's been a pronounced shift toward bolstering IT security frameworks as part of the financial software development process in order to safeguard against these sophisticated threats. By integrating more robust security protocols into financial software, employing advanced fraud detection systems, and fostering greater awareness among consumers, financial institutions aim to mitigate the impact of these crimes and protect their customers from potential losses.

Open banking practices

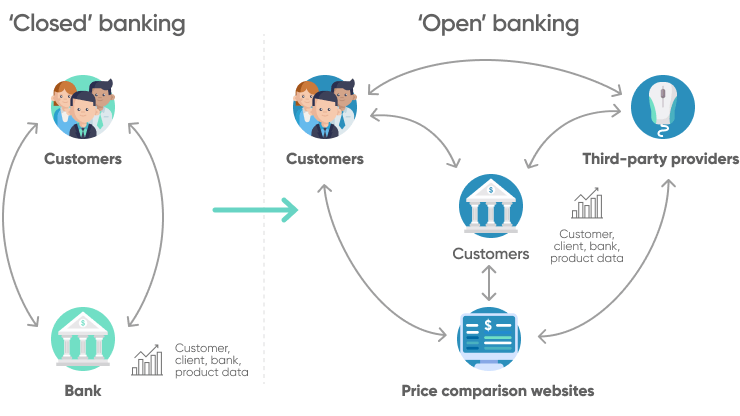

Open banking practices are revolutionizing the financial industry by providing secure access to customers' financial data across traditional banks and other institutions through application programming interfaces (APIs). This approach not only empowers customers to have greater control over their data management but also facilitates a seamless integration of technologies into banking systems, enhancing process efficiencies.

Data from 2023 shows that total payments made via open banking have doubled. This uptick underscores a growing preference for making payments directly through third-party providers (TPPs), bypassing the need for cards and heralding a shift in consumer expectations towards open banking services.

Leveraging open interfaces and APIs is becoming increasingly important. Moving from "vertical" legacy technologies to "horizontal" thinking, financial IT teams are embracing open banking practices that facilitate partnerships and technology integrations.

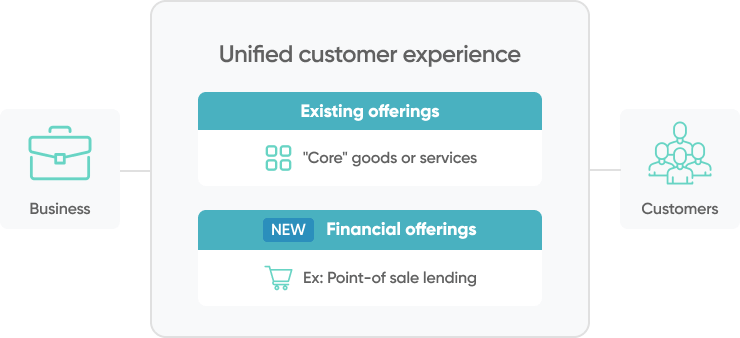

Lending-as-a-service and embedded insurance

Outside of open banking, financial institutions are looking for ways to offer their customers a fully-integrated experience. One way we’re seeing this play out is through embedded offerings across ecommerce transactions.

Lending-as-a-service and embedded insurance are two such examples of this trend that we’re witnessing in 2025. Offering payment plans, lending options, and product-specific insurance within an ecommerce checkout experience provides customers with more frictionless financial transactions and also provides financial institutions additional revenue streams.

As this new model matures, we’ll likely see software development work around embedding other services, potentially including investment services, tax assistance, and personalized financial advice. This approach not only streamlines the user experience but also opens up new avenues for financial institutions to deepen customer engagement and diversify their offerings.

Adoption of real-time payment technologies

In an effort to meet the needs of consumers for instant, convenient access to financial services, we’re seeing a pivot towards the adoption of real-time payment technologies.Unlike traditional payment methods that rely on card networks or wire transfers, these real-time solutions offer immediate fund transfers, enhancing the user experience by providing both speed and security. Several regions and companies are at the forefront of this trend, showcasing the global momentum towards embracing real-time payments:

- BLIK in Poland: A pioneering system developed by Polish banks, BLIK allows users to make secure payments and money transfers instantly without the need for cards or wire transfers, directly through their mobile devices.

- RIX-INST in Scandinavia: Part of a broader European push towards instant payment systems, RIX-INST in Sweden represents the region's commitment to real-time payments, facilitating immediate transactions across the Scandinavian financial ecosystem.

- TIPS (TARGET Instant Payment Settlement) in the European Union: As a pan-European standard, TIPS supports instant money transfers between banks, streamlining transactions across the EU with speed and efficiency that traditional payment methods cannot match.

AI for improved customer experience

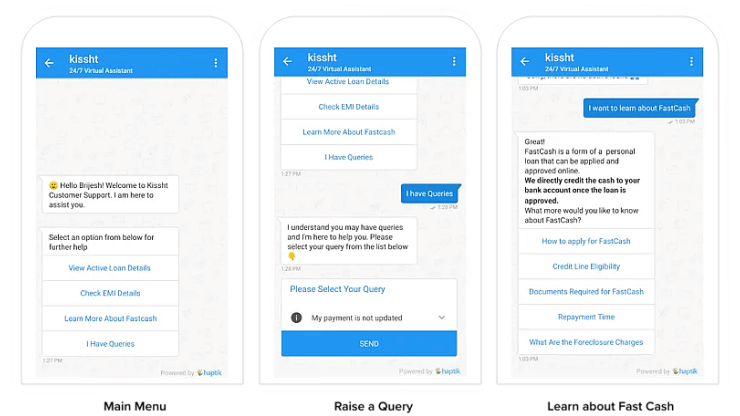

While one of the major applications of AI in the finance sector is to provide personalized experiences, more broadly, we’re also seeing companies leverage AI for improved customer experiences. AI-driven initiatives are transforming the way banks and financial institutions interact with their customers, ensuring more efficient, secure, and responsive operations

Some key examples of how we’re seeing this play out include:

- AI-powered chatbots and virtual assistants: These tools are revolutionizing customer service by providing 24/7 assistance, reducing response times, and offering instant solutions to common queries, allowing banks to manage a high volume of interactions efficiently.

- Predictive analytics for preemptive problem-solving: Banks use AI to anticipate potential issues, from system outages to unusual account activities that could indicate fraud, proactively addressing concerns to offer a more secure customer experience.

- Streamlining internal processes: AI technologies improve the efficiency of banking operations, including credit assessments and risk management, leading to reduced operational costs and faster services for customers, such as quicker loan approvals and more accurate investment advice.

Predictive analytics for better decision-making

In an era where 90% of the world's data was generated in the last two years, and data volumes double every two years, financial institutions face the monumental task of navigating through this deluge of information. Amidst this, predictive analytics emerges as a critical tool, transforming vast data into actionable insights for competitive advantage, strategic foresight, and enhanced decision-making.

In 2025 we’re seeing finance companies embrace predictive analytics, leveraging its power to address a multitude of critical areas, including:

- Stock price returns and volatility predictions are being utilized to enable informed investment decisions, maximizing returns and minimizing risks. This offers significant value through stable financial planning and effective portfolio management.

- Audit and compliance predictions help companies proactively identify potential regulatory issues, thus avoiding fines and reputational damage. This effort is crucial for securing investor confidence and ensuring market stability.

- Customer acquisition and attrition predictions are leveraged to optimize marketing and loyalty strategies. By improving customer retention and acquisition, companies directly impact revenue growth and expand their market share.

- Credit risk assessment and default predictions play a key role in informing lending decisions, setting appropriate interest rates, and mitigating potential losses. This is essential for maintaining a healthy credit portfolio and ensuring overall financial stability.

Conclusion

In the dynamic world of financial services, embracing the latest software development trends is not just a pathway to innovation but a necessity for staying competitive. As 2025 unfolds, the integration of AI, real-time payments, and open banking practices, among others, is reshaping the financial landscape, offering unprecedented opportunities for growth and customer engagement. Financial institutions that strategically adopt these advancements, with the support of specialized software development partners, are poised to lead the way in delivering next-generation financial solutions.

If you're navigating the complexities of the financial sector and seeking to innovate, our financial software development company can help transform your vision into user-ready software. Our team of experts will guide you through the software architecture, design, and development process, so you can focus on driving your business forward.

![10 Dos and Don'ts - Financial App Development [2025 Guide]](/uploads/blog/financial-app-development/financial-app-development.png)